EXCITING NEWS FOR INDEPENDENT AG RETAILS, SURVEY SAYS

At AgResource, we are dedicated to offering the highest level of support to Western Canadian independent ag retails, so they can best support Western Canadian farmers. One thing we know is that dealers need to know how they are being perceived by their customers and what their customers need. The best way to find that out is from the customers themselves.

With the constant changes to the ag retail landscape of mergers, acquisitions, online options, etc. it’s important to get an understanding of where you/independent ag retails stand with farmers, and the results are looking good.

We, with the help of Impact Group, a third-party consultant, have completed a survey of existing customers of significant ag retails across Western Canada. With responses from over 600 farmers, we have the full results and it’s looking good for independent ag retails.

“We decided to ask dealers to ask their customer base to do this survey because when dealers are thinking about their future, it’s their existing customer base that will determine their success or failure. We wanted to get a sense of retails and their loyalty due to the addition of the market of online retailers. We were absolutely thrilled with the response,” says Craig Manness, president of Impact Group and project manager for this study.

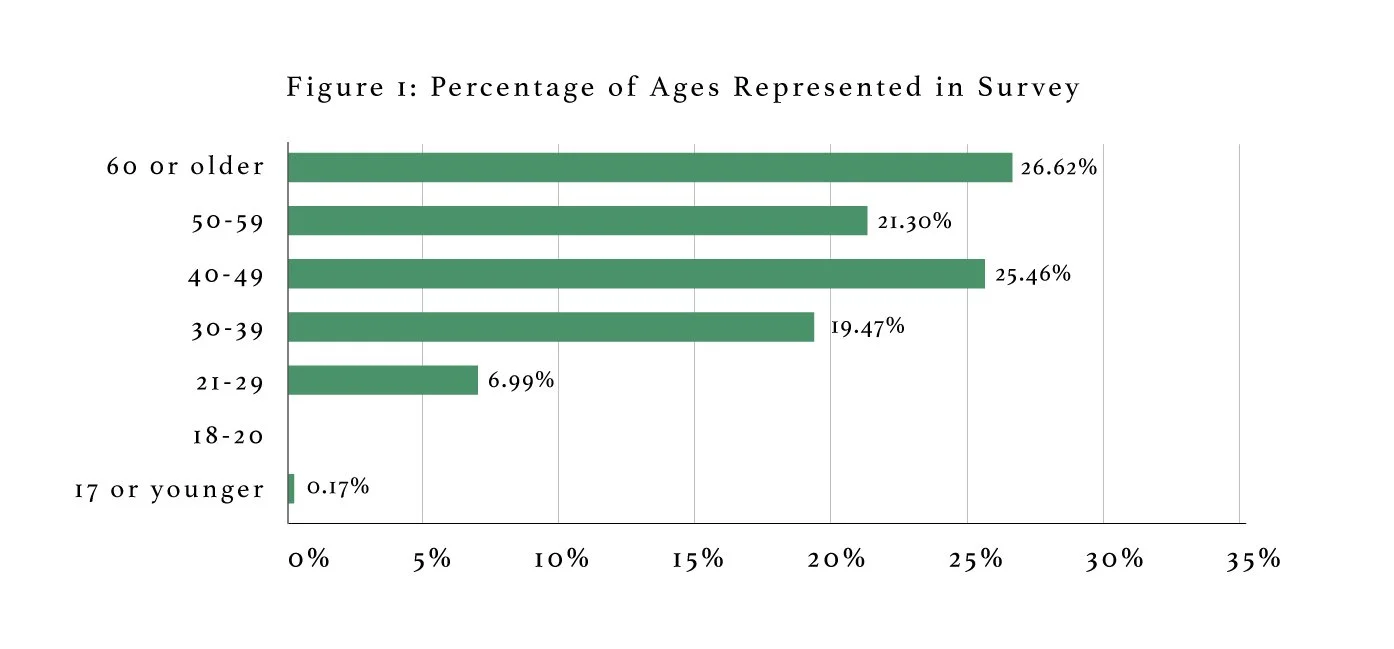

This group of farmers cover age demographics, almost evenly, from 30 to over 60 years old with one participant in the 17 or younger category. This group of farmers also cover a range of acres from the 0 to 1,500 range to the 20,000 to 30,000 range with the majority ranging from 0 to 5,000. These farmers also almost evenly cover all three provinces with 26.1 percent from Manitoba, 37.4 percent from Saskatchewan, and 36.5 percent from Alberta.

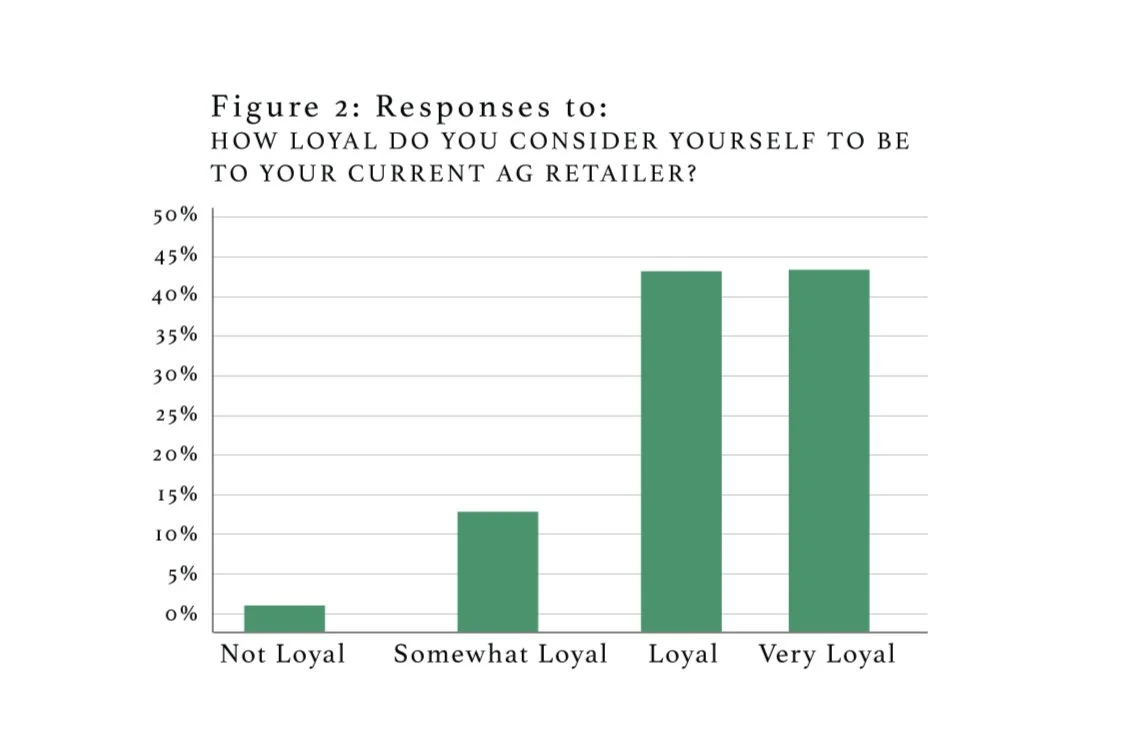

Of the farmers surveyed, 43.2 percent consider themselves to be very loyal to their ag retail with 43 percent just loyal and 13 percent somewhat loyal.

“The easiest answer to this question it ‘loyal’,” says Manness, “so we consider the responses of ‘very loyal’ to mean they’re very likely to purchase the same or more year after year.”

When it comes to the future of product purchases in the next five to ten years, 33.8 percent of farmers see themselves purchasing more from their independent ag retail, 56 percent see themselves purchasing the same amount, and only 7.5 percent see themselves purchasing less.

For crop protection product purchases in the next five to ten years, surprisingly, only 5 percent of farmers see less herbicide and 6.1 percent see less fungicide being purchased from an independent ag retail, while 41.1 percent of farmers see more fungicides, 36.1 percent see more herbicides, and 45.3 percent see more biological crop protection products being purchased from independent ag retails.

For canola seed, only 24.6 percent of farmers see themselves buying more from their independent ag retail in the next five to ten years, while 8.4 percent said they would purchase less, and 63.3 percent say they see themselves purchasing the same amount.

When asked what aspects of crop input retail service are most important and least important to farmers, product availability and agronomic and crop production advice were ranked the highest with timely response (within 0 to 24 hours) close behind. Ranked least important was the availability of online ordering options, and close behind was the option for online payment or transactions without a credit card.

Most encouragingly, independent ag retails of Western Canada will be happy to hear that 90.8 percent of farmers are either very confident or quite confident that independent ag retails will remain relevant to farmers in the future. Only 0.2 percent of the participants noted that they were not confident.

“As long as they continue to provide good service, they will remain competitive. We personally prefer dealing with local independents as they are of more benefit to rural areas,” said one farmer.

Another farmer commented, “People want the connection and service that independents bring to the table.”

“[They are a] vital link in the ag sector.”

“Overall, this study is encouraging,” says Manness; “however, it also provides watchouts. The four main reasons that independents are popular with farmers is product supply, agronomic advice, hours of operation, and quick response time. Dealers cannot let their standards erode at all or there is risk in losing loyalty. If I were a leader of an independent retail, at the end of every season when I’m building the strategy for the coming year, I would ask my team how we improve in each of those four areas. Continually improving the standard to these support services is the key to longevity.”